RIL posts highest ever consolidated quarterly PAT which increased by 76.5% Y-o-Y in Q1 FY2025-26

July 18, 2025

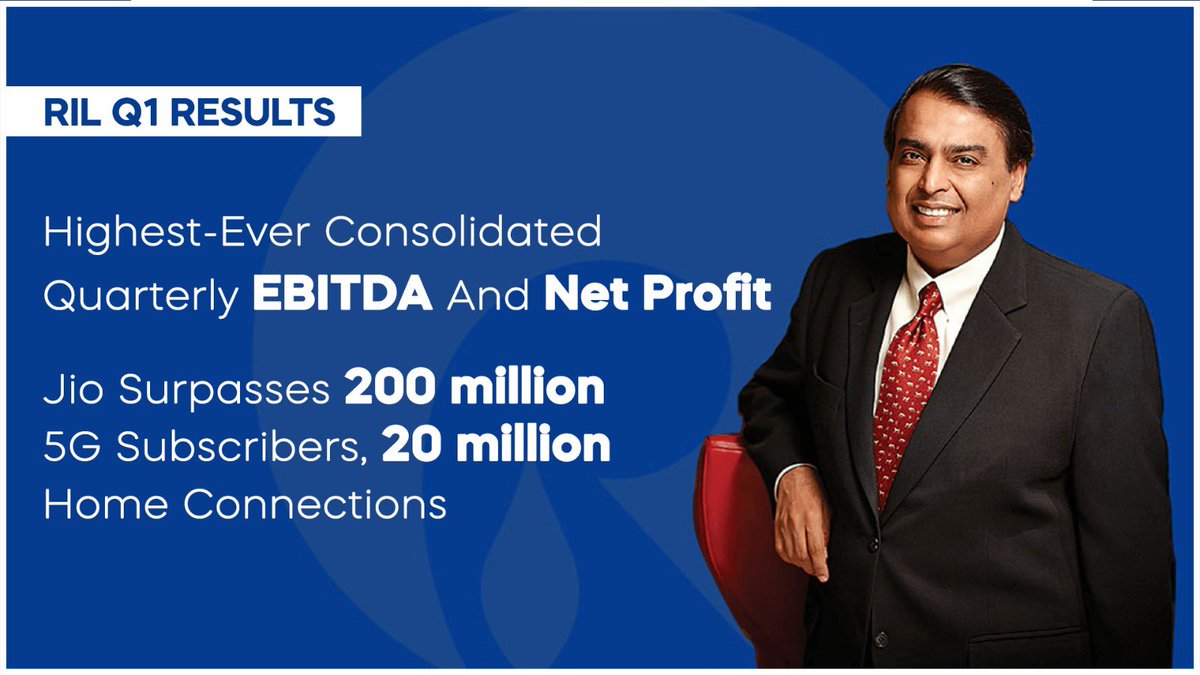

Mumbai: Reliance Industries Ltd’s fiscal first quarter net profit jumped 76.5 percent to Rs 30,783 crore, led by a gain from the sale of its stake in Asian Paints and strong growth in consumer-facing businesses. Excluding the one-time gain of Rs 8,924 crore, recurring profit still rose a solid 25 percent from a year earlier.

Consolidated revenue rose 6 percent to Rs 2.73 lakh crore, supported by strong growth in retail and digital services. Operating profit (EBITDA) jumped 36 percent to Rs 58,024 crore, with a healthy contribution from consumer businesses.

“Reliance has begun FY26 with a robust, all-round operational and financial performance. Consolidated EBITDA for 1Q FY26 improved strongly from a year-ago period, despite significant volatility in global macros,” said Mukesh Ambani, Chairman and Managing Director, Reliance Industries.

Jio Platforms posted a 25 percent rise in profit to Rs 7,110 crore, with EBITDA up nearly 24 percent to Rs 18,135 crore. Net subscriber additions remained strong at 9.9 million during the quarter, taking the total to 498.1 million. JioTrue5G users crossed 200 million, while JioAirFiber is now the largest FWA (fixed wireless access) service globally with a subscriber base of 7.4 million. Average revenue per user or ARPU rose to Rs 208.8 on the back of recent tariff hikes and seasonal reasons. Jio maintained its industry-leading customer engagement with per capita data consumption of 37 GB per month. Total data traffic grew 24 percent from a year ago to 54.7 billion GB during the quarter.

“We have delivered a milestone quarter at Jio with our 5G and Home subscriber base crossing the 200 million and 20 million marks respectively,” said Akash M Ambani, Chairman of Reliance Jio Infocomm.

Anshuman Thakur, Senior VP, Jio platforms added that Jio is one of the leading deep tech companies in India, with enormous amount of innovation and technology development done over the years. “We’ve created unparalleled tech infrastructure in the country, and most of this with our own technology stack,” he noted.

Thakur added that Jio is now one of the largest cloud players in the country, for enterprises. “And with our own JioCloud…we are now a force to reckon with when it comes to consumer cloud services as well.”

He added that Jio’s in-house developed Unlicensed Band Radio has been a great differentiator, and is helping the company ramp up the pace of its home deployment. “The targets of 100 million seem much more doable and in near time based on the use of this technology,” said Thakur.

Reliance Retail’s revenue rose 11.3 percent from a year earlier to Rs 84,171 crore, with EBITDA rising 12.7 percent to Rs 6,381 crore. Consumer brands under the FMCG business reported sales of Rs 11,450 crore in just their second year. Store additions remained brisk, with 388 new store openings, taking the total count to 19,592 across 77.6 million sq ft. The registered customer base grew to 358 million, making Reliance Retail one of the most preferred retailers in the country. Total transactions recorded were at 389 million, up 16.5 percent from a year earlier. JioMart continued to expand quick hyper local deliveries registering 68 percent sequential growth from the preceding three months and 175 percent growth of daily orders from a year earlier.

“Reliance Retail delivered resilient performance during this quarter driven by our relentless focus on operational excellence, geographical expansion and sharper product portfolio. Our continued investments in cutting-edge technologies and differentiated product offerings have enabled us to serve our customers better and scale with agility,” Isha M. Ambani, Executive Director, Reliance Retail Ventures Limited.

Commenting on the quarterly numbers, Reliance Retail CFO, Dinesh Taluja, said that Reliance Retail will be expanding our quick commerce business. “Our daily orders are up 68 % Q-O-Q basis,” he noted.

“Online grocery industry is shaping consumer habits; JioMart is the fastest growing digital app in the country today,” he added.

JioStar, the media and entertainment unit, reported gross revenue of Rs 11,222 crore and EBITDA of Rs 1,017 crore. A blockbuster IPL season helped push JioHotstar’s app downloads past 1 billion on Android and viewership to a record 1.19 billion across TV and JioHotstar. Monthly active users averaged over 460 million.

The oil-to-chemicals (O2C) business saw revenue dip 1.5 percent to Rs 1.55 lakh crore from a year earlier due to lower crude prices and planned maintenance shutdowns. However, EBITDA rose 11 percent to Rs 14,511 crore due to favourable margins on domestic fuel retail, and improvements in transportation fuel cracks. This was partially offset by lower volumes, and polyester chain margins. Reliance BP Mobility’s retail fuel network expanded to 1,991 outlets, outpacing industry growth.

Amit Chaturvedi, President, Petrochemicals, noted that polyethylene delta was down due to weak demand and overcapacity in China. However, he added that upcoming festival season likely to benefit the segment.

Oil & gas revenues also fell 1.2 percent to Rs 6,103 crore, and EBITDA slipped 4.1 percent to Rs 4,996 crore. The segment was impacted by lower KG-D6 output, lower CBM (coal bed methane) prices, and one-time maintenance expenses.

Sanjay Roy, executive vice-president for exploration and production, RIL, commented that revenues have been lower mainly due to planned shutdowns and natural decline in production from the KG D6 block. “There has been a natural decline in production but this decline has been lower than what we had envisaged,” he said.

“We will continue to augment oil and gas production. We have a rig coming in next year. We expect to undertake exploration largely around the KG D6 basin because that is the fastest way we can augment production,” said Roy, adding that the company will continue to pursue collaborative exploration.

“We are looking at further expanding exploration across the East coast,” he noted.

Capital expenditure for the quarter stood at Rs 29,887 crore, while net debt rose marginally to Rs 117,580 crore as of June 30, from Rs 117,083 crore at the end of March.

Jio Platforms Q1 net profit up 24.8%; ARPU jumps to Rs 208.8

Jio Platforms, the holding company of Reliance Jio Infocomm, on July 19 said fiscal first quarter profit rose 25 percent, led by strong subscriber growth momentum across mobility and homes, increased customer engagement and growth in digital services business.

Net profit rose to Rs 7,110 crore in the three months ended June 30 from Rs 5,698 crore in the year earlier, the company said. Jio Platforms’ revenue from operations increased by 19 percent to Rs 35,032 crore in the June quarter from Rs 29,449 crore in the previous year, driven by robust subscriber growth across mobility and homes.

EBITDA increased 24 percent to Rs 18,135 crore in the quarter, compared to Rs 14,638 crore in the same period a year earlier. The double-digit growth was primarily led by higher revenues and strong margin improvement.

Jio’s ARPU rose 15 percent to Rs 208.8 from a year earlier.

“I am happy to share that Jio has scaled newer heights during the quarter including crossing 200 million 5G subscribers and 20 million home connects. Jio AirFiber is now the largest FWA service provider in the world, with a base of 7.4 million subscribers,” said Mukesh D. Ambani, Chairman and Managing Director, Reliance Industries Ltd.

“Our Digital Services business consolidated its market position with a robust financial and operational performance. Through its differentiated offerings across mobility, broadband, enterprise connectivity, cloud and smart homes, Jio has positioned itself as the technology partner of choice for Indian consumers,” he added.

“Jio continues to create unparalleled technology infrastructure and is extending its leadership in 5G and fixed broadband. This will be pivotal in driving AI adoption in the country,” Akash M Ambani, Chairman of Reliance Jio Infocomm, said in a statement.

The telco said it extended market leadership with 498 million subscribers, with a net addition of 9.9 million in 1Q FY26. Strong subscriber addition momentum was driven by continued market share gains in mobility and record home connects.

Jio said it was a milestone quarter with 5G subscribers crossing 200 million and Home connects of over 20 million. JioAirFiber is now the Largest FWA service globally with a subscriber base of ~7.4 million.

“JioTrue5G user base crossed the 200 million milestone during the quarter and now stands at 213 million as of June 2025. Large scale adoption of JioTrue5G with differentiated customer experience has been driven by Jio’s own, end-to-end 5G stack with cloud native core network, which is ready to be taken to global markets,” the telco said.

During the quarter, Jio reached the milestone of ~20 million connected premises with fixed broadband.

Jio reported industry-leading customer engagement with per capita data consumption of 37 GB per month, and total data traffic growth of 24% Y-o-Y during 1Q FY26.

RIL O2C Q1 results: EBIDTA sees 10.8% increase

Reliance Industries Ltd’s (RIL) oil-to-chemicals (O2C) business reported a year-on-year (YoY) decline of 1.5 percent in revenue to Rs 1.54 lakh crore in the first quarter of the financial year 2025-26, on account of lower exports due to a planned shutdown of its refinery.

The segment’s EBITDA (earnings before interest, taxes, depreciation, and amortization) increased by 10.8 percent YoY to Rs 14,511 crore due to favourable margins on domestic fuel retail, improvements in transportation fuel cracks as well as PP & PVC deltas, the company said.

The oil-to-chemicals segment of RIL includes refining, petrochemicals, fuel retailing, aviation fuel and bulk wholesale marketing. It includes a large portfolio spanning transportation fuels, polymers, polyesters and elastomers.

Oil and Gas business

The oil and gas segment of the company reported a fall of 1.2 percent in revenue from last year to Rs 6,103 crore on account of lower sales volume of KGD6 gas in line with a natural decline in production. Revenue of the segment was also impacted by lower gas price for CBM gas and lower crude price realisation, the company said.

The segment’s EBITDA also declined by 4.1 percent to Rs 4,996 crore due to lower revenues coupled with higher operating costs due to maintenance activity.

The average KGD6 production for the quarter was 26.55 MMSCMD of gas and approximately 19,300 barrels per day (bpd) of oil/ condensate. Meanwhile, the average price realized for KGD6 gas was $9.97/MMBTU in Q4, compared to $9.27/MMBTU in the same period last year.

The oil and gas segment includes exploration, development, production of crude oil and natural gas.

Recent Stories

- Closure of Tapi Bridge on Ahmedabad–Mumbai Highway Extended till Aug 20

- Pakistani Mohalla in Surat renamed to Hindustani Mohalla

- Multiple rounds of heavy rains likely in Saurashtra, Kutch, during 16-23 August: Weather analyst

- NHAI Rolls Out FASTag Annual Pass; List of Eligible Toll Plazas in Gujarat

- PM Modi announces Mission Sudarshan Chakra; aims to boost national security shield by 2035

- Key Announcements by PM Modi During His Independence Day Address

- 79th Independence Day 2025 celebrations from Red Fort in Delhi | 15th August